While men make more on average, it allows women to have access to education, health, and services. The patriarchy is pretty generous after all.

Legions of feminists will ferociously type smash the patriarchy! at their Internet rallies, calling out for the end of the male supremacy in all spheres of life. Yet, few of them acknowledge the fact that one of these spheres, the government (the institution granting them rights), is entirely funded by male taxpayers. Economically, women cost more to the state than they benefit. The government is literally paying women to be alive. As such, strong independent women are only that way because the state is transferring money from men to them. Feminists are not seriously against being dependent on men, they are just against men having the full control over their money.

Let’s explore a fiscal research report in New Zealand.

The-Distribution-of-Income-and-Fiscal-Incidence-by-Age-and-Gender-Some-Evidence-from-New-Zealand-SSRN-id2375926

Legions of feminists will ferociously type smash the patriarchy! at their Internet rallies, calling out for the end of the male supremacy in all spheres of life. Yet, few of them acknowledge the fact that one of these spheres, the government (the institution granting them rights), is entirely funded by male taxpayers. Economically, women cost more to the state than they benefit. The government is literally paying women to be alive. As such, strong independent women are only that way because the state is transferring money from men to them. Feminists are not seriously against being dependent on men, they are just against men having the full control over their money.

Let’s explore a fiscal research report in New Zealand.

The real gender gap: the tax gap

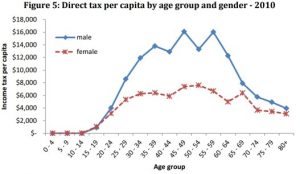

While the 77¢ for a dollar wage gap has been under the spotlight for the past years, the 200¢ for a dollar tax gap has, to my knowledge never been mentioned, at least not by our supreme feminist leaders Barack Obama and Justin Trudeau. A quick glimpse at the data reveals a massive difference in taxes paid by men and women.

The first thing that comes to mind is that half of women might be at home raising kids. However, the workforce participation rate gap between men and women doesn’t seem to exceed 10% in either age group. (see figure 4 in source)

The second thing that may come to mind as a confounding factor is that women spend more for children in education and health. Nope. No support for that either. Men and women spend approximately the same amount in both education and health (see figure 10 and 11 of the source).

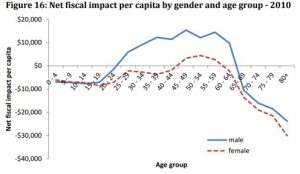

In nearly all age groups, women receive more tax than they give

With the exception of the age group between 45-59 (a 15 year span) years old, women cost more to the state than the tax they provide. In contrast, men generate more tax revenue than they cost between 23 and 65 (a 43 year span). In the brief period in which women generate more or as much tax money than they consume, men outscore them by at least 3 times.

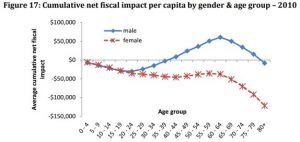

By the end of her life, the average woman will have a negative fiscal impact of $150,000

By large, the cumulative tax money given to women outweighs the tax money generated by women. The short period of positive impact of women between 45 and 59 is countered by 65 other years in which their allocated tax expenditure is more than what they supply the state.

Men, on the other hand, appear to have a positive cumulative net fiscal impact from approximately 40 until 80 years of age. For these particular taxes and public expenditures, the net fiscal incidence on men is approximately zero when cumulated over all ages. (p. 22)

Overall, the research suggests that male taxpayers are the only ones to ever have a positive contribution in taxes. Based on Figure 17, the closest that the average woman will come to having a positive fiscal incidence is when she is at minus $50,000 around 55 years of age. While feminists are demonizing men for benefiting from all liberties and rights they have constructed, they have oddly remained silent over the fact that anonymous male tax payers are paying women to exist. Read that sentence again.

The fact that feminists want a stronger government is not a coincidence. While historically, women had to choose a wealthy husband for resources, they can now stay single, be lesbians, marry a poor man, or use the sperm bank, and the state will still transfer male taxes to them. Interestingly, within 10 years of women’s suffrage, the government doubled their tax revenue and expenditure in the USA.

LottKenny

PDF: https://misandrytoday.com/wp-content/uploads/2022/05/LottKenny.pdf

These findings show just how simplistic the notion of privilege is. While men make more on average, it allows women to have access to education, health, and services. The patriarchy is pretty generous after all.

Source: avoiceformen

Women pay less tax than men – study

Researchers behind a Victoria University study have been surprised by the extent to which women, over their life cycle, pay less tax than men.

The paper which examined taxation and government welfare spending in New Zealand also found women receive more government payments than men.

Researcher Professor Norman Gemmell said it had the effect of reducing income inequality between the genders.

He said there were a number of reasons, including that women lived longer than men.

“Because they’re experiencing the longer period of pension age and they’re going to receive more pensions.

“And another reason is that women tend to spend more time out of the labour force than men, so they’re not earning income in the labour market, so they’ll not be paying tax.”

He said projections that more women and those over 65-years-old would participate in the labour force over the next 50 years could have implications.

Source: RNZ

1 comment

1 Comment

Anti

May 9, 2022, 12:09 amFlay all feminist scum!

REPLY