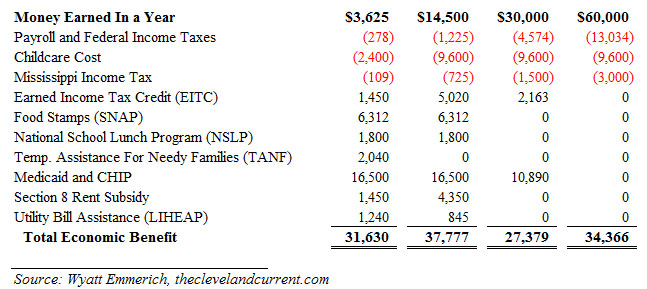

The hidden truth of where over half your tax dollars go.

In Entitlement America, The Head Of A Household Of Four Making Minimum Wage Has More Disposable Income Than A Family Making $60,000 A Year

Tonight’s stunning financial piece de resistance comes from Wyatt Emerich of The Cleveland Current. In what is sure to inspire some serious ire among all those who once believed Ronald Reagan that it was the USSR that was the “Evil Empire”, Emmerich analyzes disposable income and economic benefits among several key income classes and comes to the stunning (and verifiable) conclusion that “a one-parent family of three making $14,500 a year (minimum wage) has more disposable income than a family making $60,000 a year.” And that excludes benefits from Supplemental Security Income disability checks. America is now a country which punishes those middle-class people who not only try to work hard, but avoid scamming the system. Not surprisingly, it is not only the richest and most audacious thieves that prosper – it is also the penny scammers at the very bottom of the economic ladder that rip off the middle class each and every day, courtesy of the world’s most generous entitlement system. Perhaps if Reagan were alive today, he would wish to modify the object of his once legendary remark.

From Emmerich:

Stunning? Just do it yourself.

Almost all welfare programs have Web sites where you can call up “benefits calculators.” Just plug in your income and family size and, presto, your benefits are automatically calculated.

The chart is quite revealing. A one-parent family of three making $14,500 a year (minimum wage) has more disposable income than a family making $60,000 a year.

And if that wasn’t enough, here is one that will blow your mind:

If the family provider works only one week a month at minimum wage, he or she makes 92 percent as much as a provider grossing $60,000 a year.

Ever wonder why Obama was so focused on health reform? It is so those who have no interest or ability in working, make as much as representatives of America’s once exalted, and now merely endangered, middle class.

First of all, working one week a month, saves big-time on child care. But the real big-ticket item is Medicaid, which has minimal deductibles and copays. By working only one week a month at a minimum wage job, a provider is able to get total medical coverage for next to nothing.Compare this to the family provider making $60,000 a year. A typical Mississippi family coverage would cost around $12,000, adding deductibles and copays adds an additional $4,500 or so to the bill. That’s a huge hit.

There is a reason why a full time worker may not be too excited to learn there is little to show for doing the “right thing.”

The full-time $60,000-a-year job is going to be much more demanding than working one week a month at minimum wage. Presumably, the low-income parent will have more energy to attend to the various stresses of managing a household.

It gets even scarier if one assumes a little dishonesty is throwing in the equation.

If the one-week-a-month worker maintains an unreported cash-only job on the side, the deal gets better than a regular $60,000-a-year job. In this scenario, you maintain a reportable, payroll deductible, low-income job for federal tax purposes. This allows you to easily establish your qualification for all these welfare programs. Then your black-market job gives you additional cash without interfering with your benefits. Some economists estimate there is one trillion in unreported income each year in the United States.This really got me thinking. Just how much money could I get if I set out to deliberately scam the system? I soon realized that getting a low-paying minimum wage job would set the stage for far more welfare benefits than you could earn in a real job, if you were willing to cheat. Even if you don’t cheat, you could do almost as well working one week a month at minimum wage than busting a gut at a $60,000-a-year job.

Now where it gets plainly out of control is if one throws in Supplemental Security Income.

SSI pays $8,088 per year for each “disabled” family member. A person can be deemed “disabled” if thy are totally lacking in the cultural and educational skills needed to be employable in the workforce.If you add $24,262 a year for three disability checks, the lowest paid welfare family would now have far more take-home income than the $60,000-a-year family.

Best of all: being on welfare does not judge you if you are stupid enough not to take drugs all day, every day to make some sense out of this Mephistophelian tragicomedy known as living in the USA:

Most private workplaces require drug testing, but there is no drug testing to get welfare checks.

Alas, on America’s way to to communist welfare, it has long since surpassed such bastions of capitalism as China:

The welfare system in communist China is far stringier. Those people have to work to eat.

We have been writing for over a year, how the very top of America’s social order steals from the middle class each and every day. Now we finally know that the very bottom of the entitlement food chain also makes out like a bandit compared to that idiot American who actually works and pays their taxes. One can only also hope that in addition to seeing their disposable income be eaten away by a kleptocratic entitlement state, that the disappearing middle class is also selling off its weaponry. Because if it isn’t, and if it finally decides it has had enough, the outcome will not be surprising at all: it will be the same old that has occurred in virtually every revolution in the history of the world to date.

Related: Like High Taxes, Thank A Single Mom

1 comment

1 Comment

Russ

September 22, 2022, 5:02 amIf you keep your long term capital gains under $57k in some states, your Healthcare is near free, and you effectively pay nothing in taxes as a single person.

REPLY