A single mom can have a $60,000 to $80,000 tax free lifestyle.

For every 1.25 employed person in the private sector, 1 person receives welfare assistance or works fo the government.

Remember you have to be a single woman with a child to receive almost all welfare assistance. Think TANIF, WIC, SNAP, Section 8, Medicare, CHIP, Utility Assistance, Free Community College, and a Free Cell Phone. There are over 32 benefits because a single mom on child support and government assistance can have a $60,000 to $80,000 lifestyle. And since child support and alimony are not considered taxable income, they are technically destitute which makes them qualify for even more government assistance.

Listing just a few of the programs that only single mom’s can get.

- WIC

- TANIF (Welfare)

- MFIP public assistance (AFDC)

- Food stamps (now SNAP)

- Medical Assistance State Care

- CHIP (child healthcare)

- Head Start/Early Head StartChild Care AssistanceHousing Assistance (section 8 subsidized housing)

- Foreclosure assistance

- Mortgage assistance

- School Lunch Meals

- School Breakfast Program

- School Dinner Program

- School Break (all 3 summer meals)

- Special Milk Program

- TEFAP (another emergency food program)

- Child and Adult Care Food ProgramLow income energy assistance

- Education Assistance for the Mother (free grants and scholarships)

- Child Support Enforcement from Social Security Title IV-D: Lawyers, Collections, Case Workers, Legal Aid, and Job Training.

- Special one and one parenting skill development (they come out to their home)

- Lifeline Assistance Obama Phone program (qualify is earning less than 135-150% of poverty guideline)

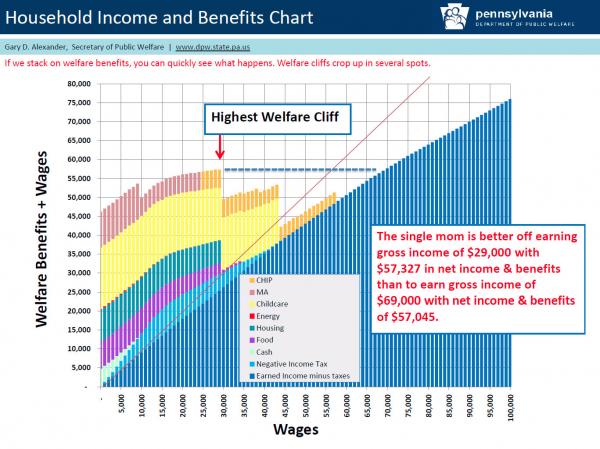

Exactly two years ago, some of the more politically biased progressive media outlets (who are quite adept at creating and taking down their own strawmen arguments, if not quite as adept at using an abacus, let alone a calculator) took offense at our article “In Entitlement America, The Head Of A Household Of Four Making Minimum Wage Has More Disposable Income Than A Family Making $60,000 A Year.” In it we merely explained what has become the painful reality in America: for increasingly more it is now more lucrative – in the form of actual disposable income – to sit, do nothing, and collect various welfare entitlements, than to work. This is graphically, and very painfully confirmed, in the below chart from Gary Alexander, Secretary of Public Welfare, Commonwealth of Pennsylvania (a state best known for its broke capital Harrisburg). As quantitied, and explained by Alexander, “the single mom is better off earnings gross income of $29,000 with $57,327 in net income & benefits than to earn gross income of $69,000 with net income and benefits of $57,045.“

We realize that this is a painful topic in a country in which the issue of welfare benefits, and cutting (or not) the spending side of the fiscal cliff, have become the two most sensitive social topics. Alas, none of that changes the matrix of incentives for most Americans who find themselves in a comparable situation: either being on the left side of minimum US wage, and relying on benefits, or move to the right side at far greater personal investment of work, and energy, and… have the same disposable income at the end of the day.

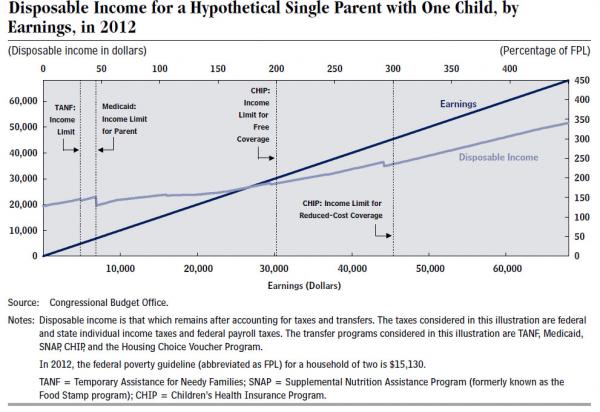

Naturally, the topic of wealth redistribution is paramount one now that America is entering the terminal phase of its out of control spending, and whose response to hike taxes in a globalized, easily fungible world, will merely force more of the uber-wealthy to find offshore tax jurisdictions, avoid US taxation altogether, and thus result to even lower budget revenues for the US. It explains why the cluelessly incompetent but supposedly impartial Congressional Budget Office just released a key paper titled “Share of Returns Filed by Low- and Moderate-Income Workers, by Marginal Tax Rate, Under 2012 Law” which carries a chart of disposable income by net income comparable to the one above.

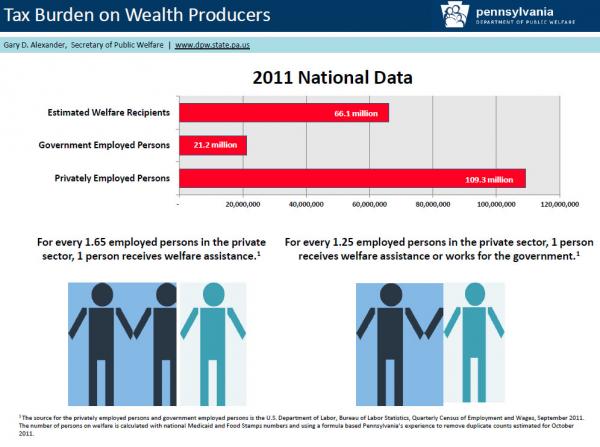

But perhaps the scariest chart in the entire presentation is the following summarizing the unsustainable welfare burden on current taxpayers:

- For every 1.65 employed persons in the private sector, 1 person receives welfare assistance

- For every 1.25 employed persons in the private sector, 1 person receives welfare assistance or works for the government.

The punchline: 110 million privately employed workers; 88 million welfare recipients and government workers and rising rapidly.

And since nothing has changed in the past two years, and in fact the situation has gotten progressively (pardon the pun) worse, here is our conclusion on this topic from 2012:

We have been writing for over a year, how the very top of America’s social order steals from the middle class each and every day. Now we finally know that the very bottom of the entitlement food chain also makes out like a bandit compared to that idiot American who actually works and pays their taxes. One can only also hope that in addition to seeing their disposable income be eaten away by a kleptocratic entitlement state, that the disappearing middle class is also selling off its weaponry. Because if it isn’t, and if it finally decides it has had enough, the outcome will not be surprising at all: it will be the same old that has occurred in virtually every revolution in the history of the world to date.

But for now, just stick head in sand, and pretend all is good. Self-deception is now the only thing left for the entire insolvent entitlement-addicted world.

11-15-2012-MarginalTaxRatesSource: Zerohedge

Related: Single Mom’s On Welfare Make More Than $60,000 A Year

Leave a Comment

Your email address will not be published. Required fields are marked with *